I architect content experiences that drive clarity, cohesion, and impact across products, platforms, and the teams that build them.

Hello!

I’m Kiran, a content designer with 8+ years of experience shaping product experiences across fintech, security, and ITSM platforms.

I simplified PayPal’s transaction model, unified its cross-brand taxonomy, and streamlined its data products unblocking multi-million-dollar deals with some of the world’s largest companies.

My work led to a 15% increase in data downloads, a 20% boost in account activations, and a reduction in activation time from weeks to days.

I bring a systems mindset to every project, combining content strategy with design thinking, to create experiences that are clear, scalable, and built to last.

I bring strategy, structure, and soul to every experience with the versatility of a writer, the mindset of a designer, and the drive of a leader.

portfolio

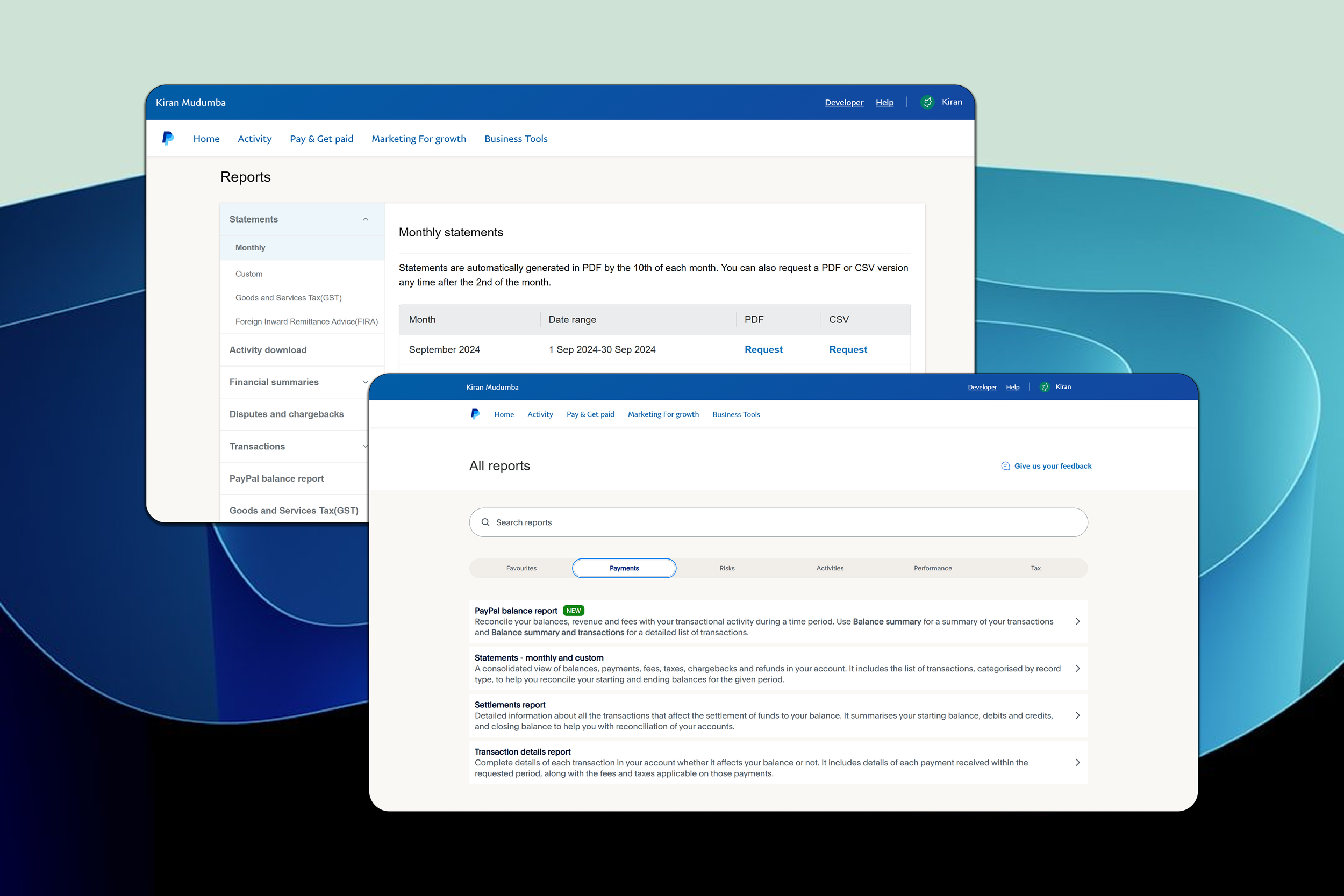

CASE STUDY: SIMPLIFYING PAYPAL REPORTS for Small business

background

PayPal’s Reports section was outdated, cluttered, and designed for enterprises and not for small businesses. Users struggled to find, access, and understand the right reports for their accounting needs.

requirement

Redesign the information architecture and establish a scalable framework that aligns with small business users’ mental models and reporting goals.

contribution

Took a content-first approach centered around building an effective IA and framework.Conducted user research, mapped user goals, restructured navigation, rewrote content for clarity, and validated the solution through testing and surveys.

RESULT

Delivered a simplified, structured experience that led to a 15% increase in report downloads and 7.5% adoption of the "favorite reports" feature. Significantly improved discoverability, usability, and set the foundation for scalable reporting enhancements.

case study: Simplifying paypal’s transactions model

background

PayPal’s transaction model had over 143 transaction types, identified only by codes. This made data integration and processing very complex. During important contract renewals with top enterprise clients, this complexity, inconsistent taxonomy, and fragmented data became major blockers. Competitors like Stripe offered much simpler and more flexible systems.

requirement

Simplify the complex transaction model and build a unified payments taxonomy to support enterprise negotiations and improve reporting usability.

contribution

Audited the existing model and redesigned the transaction structure into 15 broad types and 58 subtypes with clear, human-readable labels aligned with accounting principles. Mapped inconsistencies in taxonomy, built a data dictionary, and introduced taxonomy for fees, holds, and payment instruments. Established a Jira-based content review process. Collaborated with Legal, Compliance, Marketing, and 14 product managers to drive org-wide alignment and adoption.

result

Reduced transaction types by 66%, launched a unified disbursement report, unblocked multi-million-dollar deals, improved client trust, and enhanced PayPal’s competitive edge in the enterprise space.

case study: Ensuring compliance Without sacrificing the uX

background

A last-minute UK compliance request required adding a legal disclaimer to the Reports page, but the proposed implementation disrupted the page’s structure and confused users.

requirement

Ensure compliance with UK PSR without compromising UX or the page’s information architecture.

contribution

Researched the regulation, uncovered gaps in its interpretation, and proposed a user-centric solution that preserved the page’s UX by relocating the disclaimer to the Home page. Engaged legal, marketing, design, and product teams to build alignment and drive consensus around the revised approach.

result

Delivered a legally compliant solution with improved visibility, preserved the Reports page integrity, and secured cross-functional approval within the same timeline.

Case study: simplifying financial accounting for small business

background

Small businesses using PayPal struggled with fragmented financial data and complex experience, highlighting the need for a centralized accounting dashboard.

requirement

Refine the dashboard content and design in just two days for an upcoming leadership presentation.

contribution

Identified misalignments with user needs and redesigned the layout to deliver a meaningful, end-to-end view of the account reconciliation process. This included currency-wise balances, transaction breakdowns, and daily summaries. Aligned with the PM and designer through a visual demonstration and validated the design through user research.

result

New design was approved, piloted to 240K merchants, and achieved a 15% adoption rate in the first month. Full-scale rollout was initiated based on the pilot’s success.

Case study: reducing drop-offs in account activation

background

Only 7% of merchants activated their PayPal accounts post-signup, causing revenue leakage.

requirement

Increase merchant activation by improving guidance without making structural platform changes.

contribution

Ran content-led experiments on the “Done” page, including setup recommendations (quiz + merchant type) and personalized product suggestions based on profile.

result

Quiz-takers saw a 20% increase in activation and setup time dropped from 7 to 4 days, validating the impact of targeted, contextual content.

Past projects

Here are a few projects I did at Symantec-DigiCert six years ago. Looking back now, I'm proud of how much my craft has advanced over the course of my career. You’re welcome to take a peek into that journey.

Contact me

kiran.mudumba@gmail.com